Home sales across the US have plummeted to the lowest level in 16 years, and five spots in particular are under the threat of a complete collapse.

Potential buyers are being scared off by a rocky economy, rising HOA fees, steep mortgage and insurance rates and homes that are priced too high.

Three of the metros are former boomtowns in Florida, one is located in Texas and the other in Missouri, according to a Cotality report.

‘The main concern is that many of the Florida markets have seen significant increases in home prices, outpacing the national rate of price appreciation,’ Cotality chief economist Selma Hepp told the Daily Mail.

‘The increases in non-fixed costs of homeownership, insurance and taxes, have made it difficult for homeowners on fixed income to maintain their ownership.

‘As a result, these markets have seen a surge in for-sale inventories, which also contributes to price weakness. Lastly, many of the top five risk markets have already seen home prices come down over the last year.’

While the price of homes across the US continues to move up, the rate at which it’s climbing has slowed considerably. May saw price growth at below 2 percent for the first time in over 13 years, according to the report.

‘This is a drop compared to earlier this year when home prices were growing at above 3 percent, interest rates were slipping and the forecast for the market was stronger – even while inventory remained low,’ Hepp said.

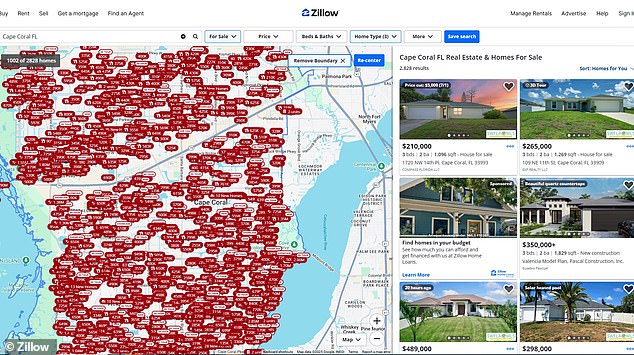

Cape Coral was a pandemic boomtown where people purchased homes sight unseen from 2020 to 2022

Lee County, where Cape Coral sits, now has around 12,000 homes available for sale

‘Now, inventory is climbing, but people are hesitant to buy. Concerns about affordability, economic outlook and elevated mortgage rates are holding buyers back. Similarly, there are now fewer cash buyers in the market indicating that the types of shoppers may be changing.’

Here are the five areas across the US which are most likely to crash:

Cape Coral was a pandemic boomtown where people were purchasing homes sight unseen from 2020 to 2022. Remote work was an option for many, but now those homeowners are looking to sell and there’s no buyers to be found.

At that time, the median home price soared 75 percent to $419,000. Now, sellers are being forced to slash prices if they want to sell.

‘A typical mortgage payment, including principal and interest, in Cape Coral, Florida- a region that has seen the most extensive price declines so far – is now about 95 percent higher than it was for a buyer who bought in 2020,’ Hepp said.

‘Current monthly payments sit at about $2,187 as compared to $1,122 in 2020.’

There are around 12,000 homes for sale in Cape Coral currently

Hepp said those who bought a few years ago are also seeing surging homeownership expenses due to jumps in insurance and property taxes.

‘Annual expenses for those costs have gone up by about 70 percent since 2020,’ she said.

‘This increase in variable costs is another reason for rising inventories since those who own second or investment homes are facing high maintenance costs for owning properties in these markets.’

Lee County, where Cape Coral sits, now has around 12,000 homes available for sale. There were just 3,500 two years ago.

‘McAllen has a higher than 80 percent probability of price decline,’ Hepp said.

In May 2025, McAllen home prices were up 4.1 percent compared to last year, according to Redfin.

Homes are currently selling for a median price of $277,000.

On average, homes in McAllen sell after 75 days on the market. In 2024, the average was 53 days.

The increase in the time on the market means that sellers will likely have to lower their asking price.

McAllen home prices were up 4.1 percent compared to last year, reports Redfin

In addition to high prices and stubbornly high mortgage rates, there are other factors making the current housing market in McAllen suffer.

Climate has had a major impact on people’s decision to buy. Natural disasters like floods and fires are a big risk and are driving up insurance rates.

Some 41 percent of properties are at risk of severe flooding over the next 30 years, according to Redfin.

Extreme wind and heat are also a big problem in the area.

The Cape Girardeau housing market is getting worse by the year.

On average, homes in the county sell after 63 days on the market compared to 29 days last year, reports Redfin.

There were 84 homes that sold in May this year, down from 97 last year.

On average, homes in Cape Girardeau County sell after 63 days on the market

In May 2025, Cape Girardeau County home prices were up 1.8 percent compared to last year, despite taking longer to sell.

Homes in the area are currently selling for a median price of $257,000.

‘Amid weaker demand, these markets are facing some downward pressure on home prices,’ Hepp said.

‘At the same time, many of these same markets have grown relatively more unaffordable over the course of the last few years, with cumulative increases in home prices averaging 60 percent to 70 percent.’

The Punta Gorda housing market is currently a buyer’s market, with prices trending downward and homes staying on the market longer.

They’re now at an average of 89 days on the market, which is higher than the past two years.

In May 2025, Punta Gorda home prices were down 7.3 percent compared to last year, according to Redfin.

Punta Gorda home prices were down 7.3 percent compared to last year, reports Redfin

Hurricane Milton slammed the area, causing less interest for buyers and raising insurance

Homes are currently selling for a median price of $435,000, and there were 85 homes sold in May this year, a metric that’s down from 98 last year.

The average homes sell for about 6 percent below list price and go into contract in around 93 days.

Multiple offers are rare in Punta Gorda.

Making matters worse, in 2024, Hurricane Milton slammed the area, scaring away buyers and raising insurance rates.

In North Port, median sale prices have declined from 2024 to 2025.

Redfin reports that in May 2025, home prices were down 9.21 percent compared to last year, and are now selling for a median price of $345,000.

Homes are sitting on the market longer here, too, currently selling after 76 days on the market compared to 53 days last year.

In May this year, there were 290 homes sold – that’s up from 263 last year.

In North Port, homes sell after 76 days on the market compared to 53 days last year

There’s simply too much inventory, with the number of homes for sale increasing year over year.

North Port generally offers more affordable housing options compared to other major Florida cities, yet still isn’t landing buyers.

According to Hepp, the market is showing ‘a split character’ across the country.

‘The Northeast and the Midwest are home to some of the hottest markets in the country while Texas and Florida, are posting negative home price growth,’ she said.

Variation in price growth, she said, is driven in large part by inventory.

‘At the same time, many of these same markets have grown relatively more unaffordable over the course of the last few years, with cumulative increases in home prices averaging 60 percent to 70 percent, compared to the overall national increase of 48 percent since spring of 2020.’

Prices in many housing markets have hit a wall, leading to more areas with falling or slowing year-over-year prices.

‘Still, as the national index suggests, more markets continue to see some growth which is driving the overall national increase,’ Hepp said.

‘However, with the annual growth rate now slower than the rate of inflation, real home prices are falling, which suggests improved affordability going forward.’